Writing a Will

Fewer than half of UK adults have written a will. That leaves 26 million people with no formal instructions for what should happen to their possessions after their death.

Here's why writing a will is important:

- You control your estate: A will allows you to decide who inherits your money, property, and possessions (your estate) after your death, instead of relying on the government's intestacy rules.

- Avoid intestacy rules: If you die without a will (intestate), the law dictates how your assets are distributed. This may mean that your estate is passed to family members you do not know or are estranged from.

- Reduce stress for your loved ones: Writing a will makes the process of dealing with your estate much simpler for your family and minimizes the chance of disputes during a difficult time.

- Potentially reduce inheritance tax: Strategic planning within a will can help minimize the amount of Inheritance Tax payable on your estate.

- Provide for your children: A will allows you to appoint guardians for children under 18, ensuring their care and future are in the hands of someone you choose.

- Include unmarried partners: Unmarried partners have no automatic right to inherit without a will, so it's crucial to specify your partner as a beneficiary to protect their financial future.

- Leave gifts to charity or organizations: You can use your will to leave a legacy to causes important to you.

- Make funeral wishes clear: A will can detail your preferences for your funeral arrangements e.g. burial or cremation.

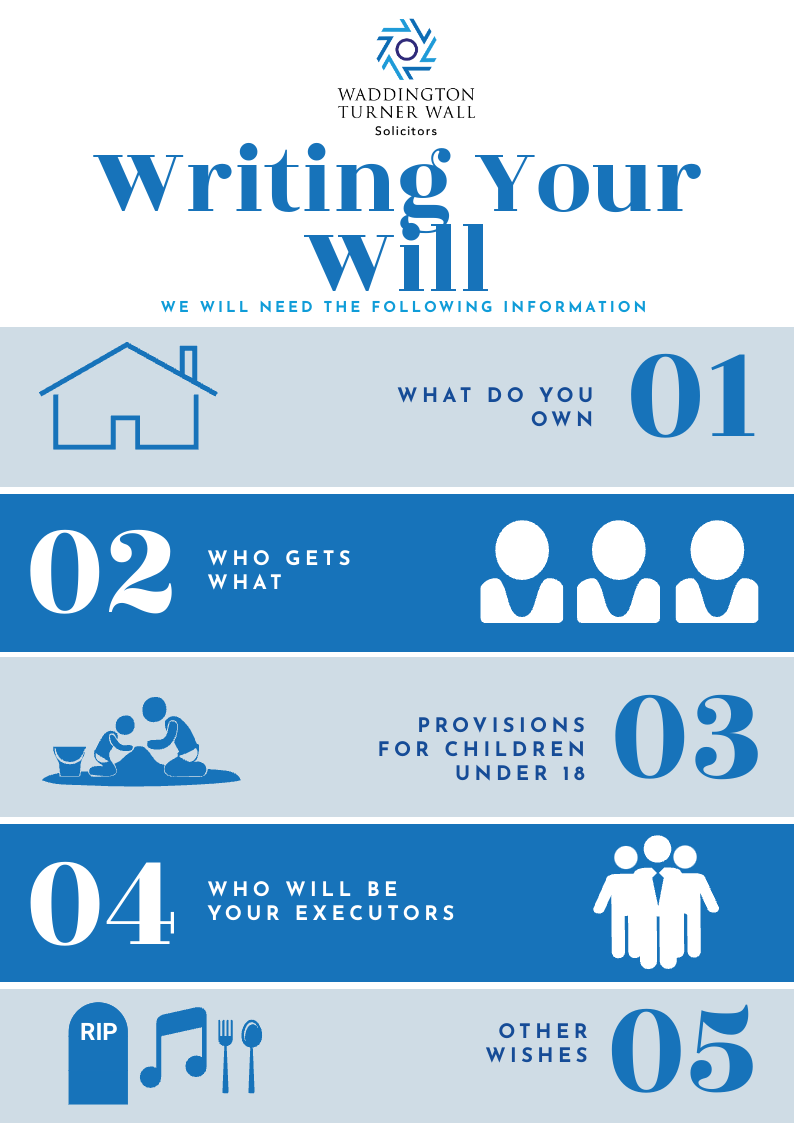

- Using a professional: Ensures that your will is drawn up correctly. This can help to avoid possible family fall outs after your death and ensures that the will is valid.

To discuss writing or updating your will please call us on 01535 662644 and speak to one of our experienced Wills, Probate and Later Life Planning Team.

Initial Enquiry

We would be delighted to explain how we can help you. To speak to one of our team: